Jakarta, 15 January 2024 – Fiscal has a strategic function in encouraging economic growth, supporting the investment climate, redistributing income, encouraging equality, while providing protection for the poor and vulnerable. These functions are increasingly needed, especially in conditions of high uncertainty like today.

The implementation of the 2023 State Revenue and Expenditure Budget (APBN) is taking place in an atmosphere that is not yet bright. Even though the effects of the pandemic have disappeared, the economy is still haunted by disruption. The triggers are varied, including rising global geopolitical tensions. Around 74 countries are holding elections this year which could trigger political turmoil. There are still supply chain disruptions and commodity price volatility. Meanwhile, economic growth in various countries is weakening and uneven.

However, the implementation of the 2023 APBN is running relatively smoothly. Actual APBN spending reached IDR 3,121.9 trillion, exceeding the APBN target of IDR 3,117.2 trillion. The amount of actual spending also increased by 0.8% from the 2022 realization of IDR 3,081.2 trillion. State spending has exceeded IDR 3,000 trillion since 2019.

Realized state revenue reached IDR 2,774.3 trillion, or 112.6% of the initial 2023 APBN and 105.2% of the revised APBN contained in Presidential Decree 75/2023, amounting to IDR 2,673.2 trillion. This income also grew 5.3% compared to the realization in 2022.

With this posture, the 2023 APBN recorded a deficit, but only IDR 347.6 trillion or smaller than the initial target of IDR 479.9 trillion. “The realization of our deficit is almost half of the original design,” said Sri Mulyani at the 2023 APBN Performance and Realization Press Conference, at the Ministry of Finance Building, Jakarta, Tuesday (2/1/2024).

In the original design of the 2023 APBN, before it was revised, the budget deficit was pegged at IDR 598.2 trillion or 2.84% of GDP. The deficit was revised to 2.2% of GDP. In reality, the deficit turned out to be only 1.65% of GDP.

According to the Director General of Budget at the Ministry of Finance, Isa Rachmatarwata, this deficit is the lowest since 2011. In that year, the APBN deficit reached a nominal value of IDR 84.4 trillion or 1.14% of GDP.

Apart from achieving a surprising deficit, the primary balance of the 2023 APBN also posted a surplus, the first time this has happened since 2012. The surplus was recorded at IDR 92.2 trillion. Primary balance is the difference between total state income minus state expenditure excluding debt interest payments.

According to the Head of the Fiscal Policy Agency, Febrio Kacaribu, a primary balance surplus indicates a healthy APBN condition, supported by a growing national economy.

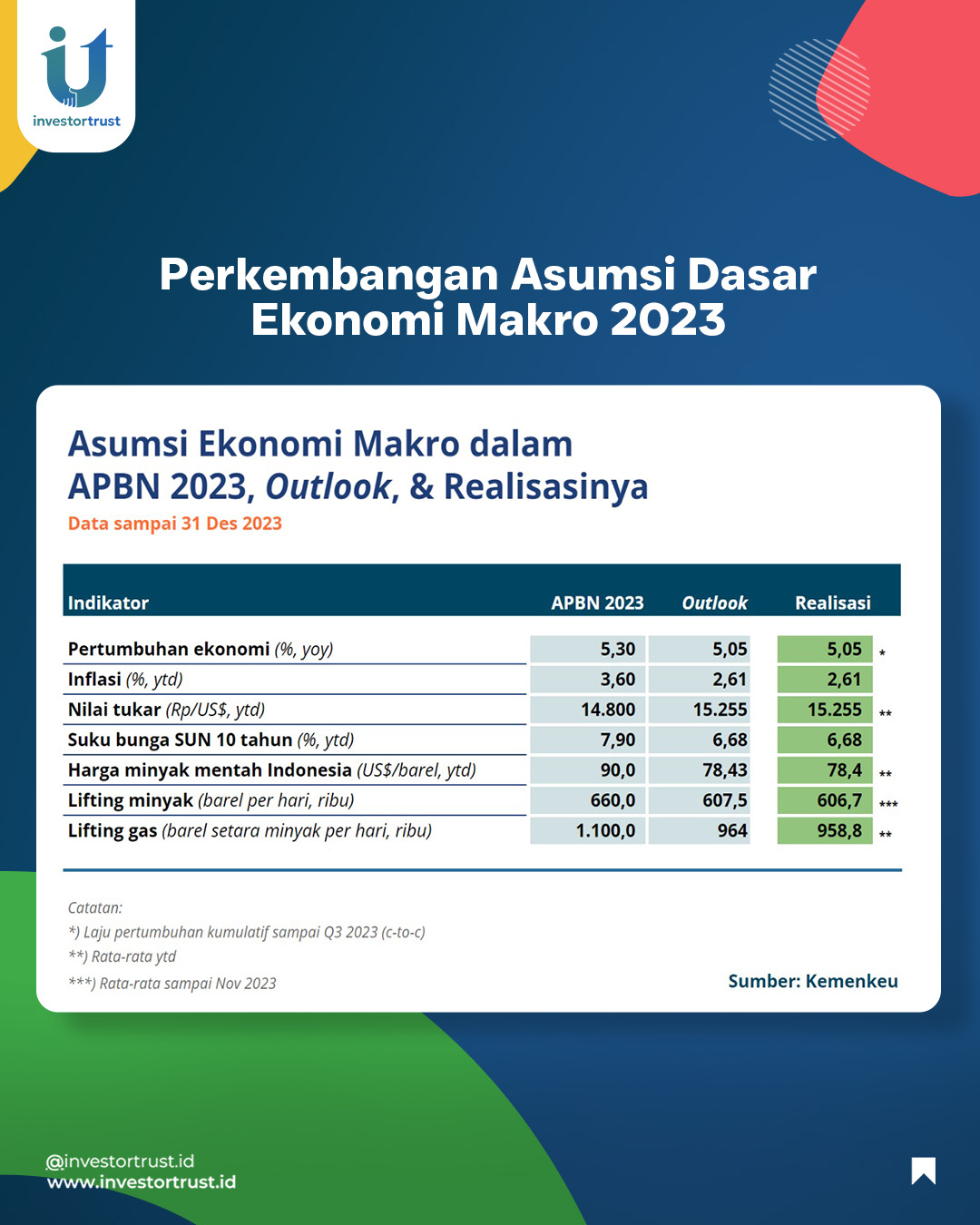

Another quite positive indicator of the realization of the APBN is the amount of debt interest which continues to decline. The interest rate on government securities (SBN) reached 6.68%, lower than the 2023 APBN assumption of 7.9%.

The 10-year SBN yield denominated in rupiah and foreign currency also fell. At the beginning of the year, the 10 year SBN yield was in the range of 7%, while at book closing the value was 6.48%. “Why are debt yields low? Because investors believe. “Global investors choose debt securities that are more credible,” said Febrio.

The Minister of Finance stated that the figures for the realization of the 2023 APBN are still preliminary because they are waiting for the results of the audit by the Supreme Audit Agency (BPK) and accountability to the DPR which will be submitted in mid-2024.

Source: Ministry of Finance, investortrust.id

Tax

Of the state revenues of IDR 2,774.3 trillion, tax revenues dominate, namely IDR 2,155.4 trillion. This figure is 106.6% of the initial APBN target or 101.7% of Presidential Decree 75/2023, and an increase of 5.9% from the realization in 2022.

Tax revenues include tax revenues of IDR 1,869.2 trillion (108.8% of the initial APBN or 102.8% of Presidential Decree 75/2023; customs and excise of IDR 286.2 trillion (94.4% of the 2023 APBN or 95), 4% of Presidential Decree 75/2023.

Furthermore, PNBP reached IDR 605.9 trillion (137.3% of the 2023 APBN or 117.5% of Presidential Decree 75/2023, or a growth of 1.7% compared to the realization in 2022. High PNBP growth was mainly supported by BUMN dividends and non-oil and gas natural resource revenues, even though oil and gas natural resource revenues contracted due to oil moderation.

Sri Mulyani appreciated the tax achievement which was above 100%. This performance must be maintained and the tax base expanded through improved supervision and services.

Tax revenue growth in 2023 will reach 7% due to the high growth base of the previous year. In 2021 and 2022, growth in state revenue from taxes will increase significantly, 35% and 40% respectively.

For spending, the realization of transfers to regions in 2023 will reach IDR 881.3 trillion (108.2% of the 2023 APBN ceiling). This is the highest record in the history of transfers to the regions so far.

Meanwhile, the realization of 2023 budget financing reached IDR 359.5 trillion (60.1% of the 2023 APBN target). Realized debt financing amounted to IDR 407.0 trillion. Meanwhile, investment financing of IDR 90.1 trillion was channeled via PMN to BUMN and investment to the Public Service Agency (BLU).

Source: Ministry of Finance, investortrust.id

Disbursement Speed Is Problematic

This does not mean that implementing the 2023 budget will not have problems and obstacles. One of the issues that has been a classic problem for years is speed in shopping. Until now, budget disbursement is still being accelerated at the end of the year. Many agencies or ministries/institutions (K/L) tend to waste and create activities they are looking for towards the end of the year, simply because the remaining budget is still large.

A senior economist who is now a high-ranking government official once quipped that Indonesia is good at capturing state revenues, but has problems with spending.

Minister of Finance Sri Mulyani herself admitted that the quality and speed of ABPN spending were still problematic. He said these two things were critical points at the end of the Jokowi administration.

One example of a problem with APBN spending is disbursement at the end of the year. The Ministry of Finance cash office, which was supposed to close on December 29, ended up remaining open until December 31 2023. The Ministry of Finance is still providing budget disbursement during the two days of injury time.

In fact, in the last 12 working days, the Ministry of Finance disbursed IDR 533.7 trillion in funds. This shopping expenditure is divided into three clusters. Cluster one is transfers to regions in the form of payments from Profit Sharing Funds (DBH) and General Allocation Funds (DAU). Cluster two is fertilizer subsidy payments and cluster three is Government Capital Participation (PMN) payments.

Another note regarding the shortcomings of the 2023 APBN is that the basic macro assumptions are below expectations. Of the seven macro assumptions, only two met the target, five assumptions missed or were below expectations.

Middle class

Apart from that, an interesting aspect that is also being discussed regarding fiscal policy is the need for subsidies for the middle class which has so far been neglected. Because the government focuses on the poor.

It was former Minister of Finance Chatib Basri who reminded this matter, referring to the Chilean Paradox. An irony and paradox that occurred in Chile. Chatib said that Chile is a country with high economic growth and can reduce poverty from 53% to 6%. However, due to social unrest, millions of middle class people took to the streets and protested against the government.

Based on this suggestion, Minister of Finance Sri Mulyani stated that the government needed to adjust or calibrate policies for the middle class group. This happens because so far, the government’s fiscal policy has focused on low-income groups.

Sri Mulyani said that the middle class has different behavior. Purchasing power is also different. Therefore, the government must ensure the availability of public services of good quality and affordable prices. Especially for education, waste, clean water, electricity, internet and other middle class needs.

Ahead The Curve

In general, fiscal 2023 has carried out its function well. Lots of positive surprises. The Minister of Finance claims that the 2023 APBN has succeeded in making himself healthy and making the national economy healthy, while protecting the community through various social assistance.

“To put it in one word, our APBN is ahead of the curve. “Our achievements are much faster than we expected or designed,” said the Minister of Finance.

Relatively strong domestic economic fundamentals provide an effective cushion for the implementation of the 2023 APBN. In the midst of uncertainty, the Indonesian economy in 2023 remains resilient, able to grow above 5%. Inflation is maintained. The trade balance recorded a surplus for 43 consecutive months. The manufacturing index (PMI) has been in the expansionary zone for 28 consecutive months.

In the portfolio market, there was a net inflow of up to IDR 80.4 in the SBN market, although there was an outflow in the stock market. The 10-year SBN yield decreased to 6.74 percent. The Minister of Finance considered this to be proof of investor confidence in SBN, the rupiah and the economy in general.

It is hoped that fairly solid economic fundamentals and a healthy 2023 APBN will provide a solid foundation and catalyst for the implementation of the 2024 APBN and a better domestic economy. However, problems that hamper budget implementation must be resolved, including corruption and persistent budget backlogs. (HG)

The original article in Bahasa Indonesia can be accessed here