JAKARTA -More than a decade after launching the first Islamic Bank, Indonesia is once again attempting to create a vibrant Islamic financial sector in parallel with the traditional banking sector to attract new capital investments from the Middle East and Malaysia.

On February 1st, President Joko Widodo launched Bank Syariah Indonesia (BSI), through the merger of three state-owned Syariah Banks – Bank Syariah Mandiri, BNI Syariah and BRI Syariah. The publicly-listed bank is already among the top 10 listed stocks on the Indonesian Stock Exchange by capitalisation coming in at Rp 114 trillion (S$1.14 billion).

BSI starts its new life on a relatively sound footing with consolidated assets at Rp 240 trillion; 1,200 branches and 20,000 employees. “We realize our responsibility is not just consolidating the assets of the three banks but also to transform it to improve its business model, risk management, human capital and digitalization,” said Heri Gunardi, president director of BSI at its recent virtual launch.

He added that the bank would focus on wholesale banking, especially the infrastructure sector as well as growing its retail client base by offering digital banking to Muslims.

President Widodo also tasked the bank’s board of directors compete with traditional banks by adopting digital technology to reach the unbanked; attract millennials who make up 25 percent of the population develop new innovative banking products fro SMEs and micro-enterprises.

This is the crux of the challenge for Islamic or Syariah banks in Indonesia. In the past the Syariah banks never took off because they could not compete with traditional banks in terms of financial products, providing liquidity to investors and growing their corporate business.

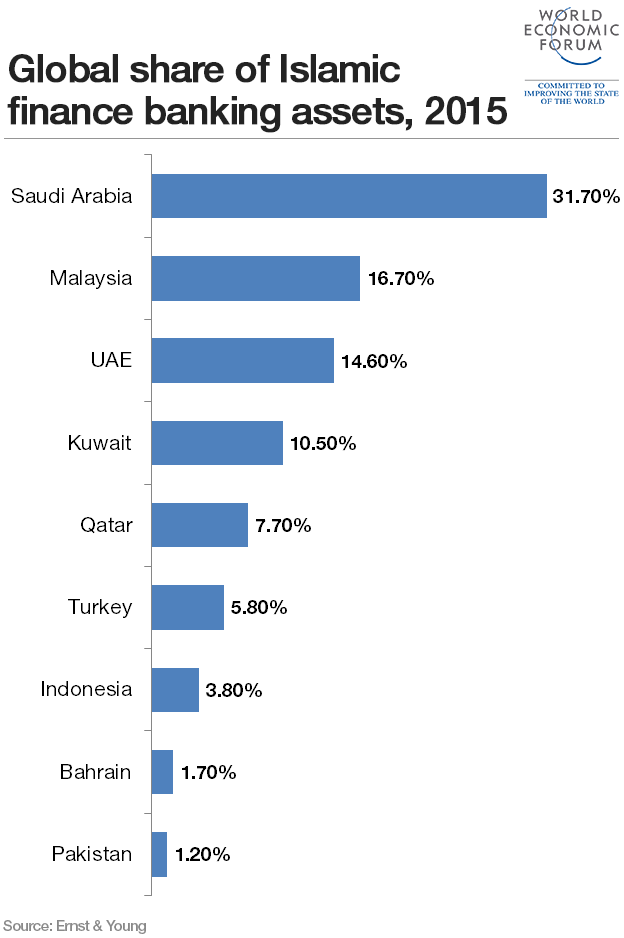

Eventhough Indonesia has the largest Muslim population in the world, its Syariah banking sector is small compared to Malaysia and the Gulf states. Indonesians and investors alike were not drawn to Islamic banks just because they governed by Syariah or Islamic Law.

“Consolidation of State-owned Shariah banks should be viewed as a much needed move if the government is intent on broadening and deepening its appeal to retail consumers with new product offerings and fintech innovation in mind,” said Edward Gustely, managing director of Peninda Capital Advisors.

He added that traditional retail banks are facing the same challenges as Syariah banks but still represent over 90 percent of the market. “Both Syarah and traditional banks are competing for the unbanked market which is being served by fintech startups that focus on peer to peer lending and other offerings via mobile apps.”

It is also hoped that the new merged entity would attract foreign capital especially from the Gulf states and Malaysia by investors looking to expand their portfolios and access Indonesia’s vast domestic market.

State-owned Enterprises (SOE) minister Erick Thohir noted that the government was open to cooperating with investors who would like to buy equity stakes in BSI. “We are also seeking to get a license in other markets such as Dubai so we can have access to global capital,” he noted.

The minister added that the new merged entity is expected to be a top 10 global player by 2025 so as to be able to compete with Saudi Arabia’s Al-Rajhi and Albiland Bank. With US$97.3 billion in assets, Al-Rajhi is he largest Syariah bank in the world.

“To achieve that goal, we will need to increase the capital for BSI. “We plan to do a rights issue in the future and we are open to cooperating with investors as move ahead,” Thohir noted.

Nafan Aji Utama, an analyst at Binaartha Sekuritas said that the new bank would need to seek strategic investors who would not only provide capital but also expertise in Islamic financial products and services as well as digital banking.

The other option would be to attract investors such as the Abu Dhabi Investment Authority and the Emirates Investment Authority through the Indonesia Investment Authority (INA), the country’s sovereign wealth fund.